Business

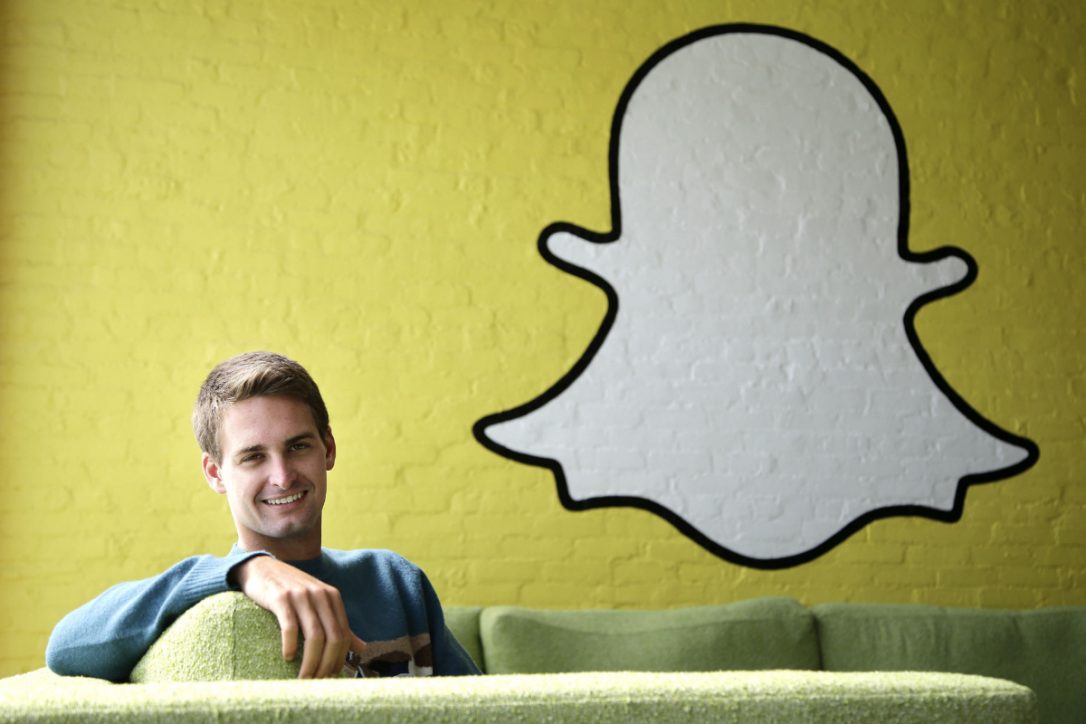

Snapchat CEO’s Social Media Vision is Paying Off

LOS ANGELES — When Evan Spiegel and Bobby Murphy were undergraduates at Stanford University, they made an unconventional observation about what makes a social network valuable.

Thanks to the rise of Facebook, most everyone believed that networks became exponentially more valuable by amassing more users. But Spiegel noticed that in real life, even people with thousands of acquaintances spent most of their time with just a few friends whose value outweighed a large number of looser ties.

So when Spiegel and Murphy created Snapchat in 2011, they inverted the social networking dynamic. Out of their Stanford dorm rooms, they made Snapchat as an app that would send disappearing messages and photos in a way that more closely mimicked the dynamics of a real world conversation. That would increase the appeal of Snapchat as a service that people used with a small number of good friends, they figured.

While online identity previously emphasized everything anyone has ever done, with Snapchat “my identity is who I am right now,” Spiegel said in a 2015 video to describe the app.

Spiegel, 26, Snap’s chief executive, has since built a budding digital empire based on that initial unconventional insight — and has continued upending the tech industry with his different way of seeing the world, often with a touch of ego. Rather than accept the norms of the social networking ecosystem, he has stuck to atypical viewpoints on matters from mobile video to video-recording spectacles. And he has done all of this more than 350 miles away from Silicon Valley, in the sunny climes of Venice, California, where Snapchat is based.

Spiegel’s singular approach will soon be more publicly on display. This week, Snapchat’s parent company, Snap, is expected to reveal its public stock offering paperwork. The filing will show how Snap is doing as a business and whether that justifies a public valuation of $20 billion to $25 billion, which the company has been reported to be seeking. It will also disclose Spiegel’s ownership stake in Snap; the public offering is set to vault Spiegel and Murphy, who is chief technology officer, into the ranks of other tech billionaires.

Along with financial information, Spiegel is expected to include remarks about Snap’s mission that will showcase his zag-while-zigging philosophy.

“If you want to understand Snap, look at Evan Spiegel,” said Todd Chaffee, a partner at IVP, one of Snap’s three largest venture capital investors. “He is the visionary who drives that company.”

Mary Ritti, a spokeswoman for Snap, declined to comment for this story.

Spiegel grew up in Pacific Palisades, a wealthy Los Angeles suburb, and attended Crossroads, a prep school in Santa Monica, California, that counts Jonah Hill, Kate Hudson and Jack Black as alumni.

He lived a privileged life, with expensive cars, exclusive club memberships and fancy vacations, according to records from his parents’ divorce proceedings. His father, John Spiegel, a securities lawyer who helped overhaul the Los Angeles Police Department after the Rodney King beating in 1991, also had his children volunteer and build homes in poor areas of Mexico.

While many techies talk about how the industry is a meritocracy, Spiegel has not shied from his wealthy roots. In public comments, he has said he is “a young, white, educated male who got really, really lucky. And life isn’t fair.”

At Stanford, also his father’s alma mater, Spiegel majored in product design and started a handful of companies with Murphy, a fellow Kappa Sigma fraternity brother. (Their early startups flopped.) There, Spiegel also met some of the men who would become his mentors, including Scott Cook, then the chief executive of Intuit, and Eric Schmidt, the Google chairman, who taught an MBA class that he attended.

Spiegel “really is the next Gates or Zuckerberg,” Schmidt said in an interview, comparing the Snap chief to Microsoft’s co-founder, Bill Gates, and Facebook’s chief, Mark Zuckerberg. “He has superb manners, which he says he got from his mother. He credits his father’s long legal calls, which he overheard, to giving him perspective on business and structure as a very young man.”

When Snapchat started taking off, Spiegel did not wait to graduate from Stanford. He moved the company to the Venice Beach boardwalk, away from what he perceived as Silicon Valley’s too-narrow focus on technology.

His decamping for Southern California put off some in Silicon Valley. The perception of a divide with Silicon Valley was also fostered by Spiegel’s rejection of a $3 billion acquisition offer from Facebook in 2013. Some who met Spiegel during Snapchat’s early days at Stanford describe him as akin to the villain of a 1980s teen movie. He often came across as having a healthy ego, an impression Spiegel sometimes stoked.

When Spiegel met Institutional Venture Partners to discuss possible fundraising, for example, he told IVP’s partner, Dennis Phelps, that he was unwilling to accept the firm’s standard investment terms.

“If you want standard terms, invest in a standard company,” Phelps recalled Spiegel telling him. IVP went on to invest in Snap’s third financing round in 2013.

In Los Angeles, Spiegel has shown interest in the city’s fashion, art and music scene. He met his fiancée, the model Miranda Kerr, at a Louis Vuitton dinner. And he once toyed with the idea of owning a record label with ties to Snapchat, according to a 2015 email between Sony executives that was released by hackers.

“He’s different from most tech people because he knows what’s cool and what’s next,” said Ryan Wilson, an artist in Los Angeles who worked with Spiegel on a piece of art for one of Snapchat’s offices. “He doesn’t like things because a dealer says he should. He just likes what he likes, whether it’s made by a high school friend or a famous artist.”

Spiegel has involved himself in some political conversations. In 2015, he met with China’s president, Xi Jinping, as a member of the 21st Century Council at the Berggruen Institute. Its founder, Nicolas Berggruen, said he impressed a group that includes Mohamed El-Erian, the economist, and former president Nicolas Sarkozy of France with his “thoughtful and mature approach to people.” Last fall, Spiegel also attended a private dinner with John O. Brennan, then the director of the CIA. According to multiple attendees, Spiegel listened more than he spoke and had the ear of Mayor Eric Garcetti of Los Angeles.

Spiegel’s unconventional streak may be most evident in how he has steered Snap. He has long said that a public offering was what was best for the company and its investors, even as other tech startups chose to stay private as long as possible.

Since Snapchat’s debut, the app and the company have also undergone dozens of changes that were criticized for being too different from other consumer internet companies.

Spiegel rejected the idea of a newsfeed in Snapchat’s app, for example, because he said people prefer stories chronologically. In Facebook’s News Feed, posts are reverse chronological, meaning the newest posts are at the top.

Unlike other social networks, Snapchat also does not use algorithms to push people to see certain content. Snapchat users swipe their screens to navigate and view video vertically, rather than tap on menus or turn their phones to watch videos horizontally.

“From what I can figure out, he thinks differently about the way to monetize and develop a social network,” Schmidt said of Spiegel.

Investors who buy into Snap’s initial public offering will soon be getting a piece of that approach.

Allowing “ourselves to be pulled in another direction” is what makes us human, Spiegel said in a commencement speech at the University of Southern California’s Marshall School of Business in 2015. Quoting John F. Kennedy, he added, “Conformity is the jailer of freedom and the enemy of growth.”ead More..

Business

Beauty Week is back at Hudson’s Bay in Toronto and it’s time to get glam

Beauty enthusiasts rejoice! Beauty Week at Hudson’s Bay is back in Toronto for another year. It’s time to stock up on all of your fall essentials and, maybe discover some new ones.

From Friday, August 18 to Sunday, August 27, you can expect a truly elevated beauty experience in-store with incredible special offers, limited-time gifts, and exciting activations.

If you’re a diehard beauty lover, you’ll already know that Hudson’s Bay is the place to shop thanks to its extensive range of over 195 skin and makeup brands from both luxury labels and masstige brands — including Tata Harper, Estée Lauder, YSL, Nars Cosmetics, Bobbi Brown, and so much more.

Throughout The Bay’s Beauty Week, visitors can take in some at-counter activations and interactive expert-led tutorials, where there will be chances to get makeup touch-ups from top-tier brands, try a spritz of the most alluring fragrances, and sample tons of new products.

This year’s Beauty Week highlight is the ‘Best in Beauty’ tote, a meticulously-curated selection of 30 deluxe samples from an array of top-tier brands like Dr. Barbara Sturm and Shiseido spanning skincare, fragrance, and makeup — all in a super sleek bag.

The tote, which is valued at over $300, is retailing for just $39 and is a fantastic way to explore new products (without breaking the bank). However, there is a limited quantity, so if you want to get your hands on one, you’ll need to be fast.

Wondering exactly what Beauty Week’s free gifts with purchases entail? If you spend over $95 at Lancôme, you will receive a six-piece set valued at $130. Or, you can get an Estée Lauder gift valued at $170 with purchases over $80. (And that’s just to name a few.)

If you’re a Hudson’s Bay Rewards member, you’ll also get $20 in Hudson’s Bay rewards when you spend over $100 on beauty.

Business

The Canadian Armed Forces are hiring for several non-combat military jobs

The Canadian Armed Forces (CAF) have several non-combat jobs, some of which do not require a college degree or past work experience.

Life in the forces has several benefits, such as paid education plans (college, university and graduate-level programs), 20 paid vacation days, health and dental coverage for you and your family, maternity and paternal leave, and pension plans. You can learn more about the benefits in detail here.

And to make it easier to gauge if you qualify, the listings also include related civilian jobs to see if it’s your ideal role.

Financial services administrator

Related civilian jobs: Financial records entry clerk, financial manager, accounting technician, bookkeeper, budget officer, cashier clerk, business planner technician, and verification manager.

Description: You’ll help budget resources for all military activities besides providing financial assistance.

Education: You need to have completed Grade 10.

Duties: As a financial services administrator, you’ll be responsible for bookkeeping and managing budgets. You’ll also provide support in accounts payable and accounts receivable.

Work environment: Those in this role work at CAF bases, on ships or overseas. You might also be expected to help special operation units, recruiting offices, schools, and medical organizations.

Postal clerk

Related civilian jobs: Mail clerk, mail sorter.

Description: You’ll provide postal services to members and their families at bases and establishments.

Education: Grade 10. No previous work experience or related career skills are required.

Duties: As the postal clerk, you’ll handle mail duties.

Work environment: Besides a postal office, you may work on a ship or a mobile postal van. You might be expected to serve with Royal Canadian Navy, the Army, and the Royal Canadian Air Force in Canada and abroad.

Dental technician

Related civilian jobs: Dental assistant, dental hygienist.

Description: You’ll be helping dental officers provide dental services to CAF members, their families, and dependents.

Education: Level II dental assisting diploma from an accredited college or a National Dental Assisting Examining Board (NDAEB) certificate.

Duties: Those in this role will be responsible for various responsibilities, including disinfection and sterilization of dental equipment, applying rubber dams, placing cavity liners, and controlling bleeding. In addition, you’ll assist in laboratory procedures like creating casts, custom trays, and mouthguards.

Work environment: This role will require you to work in a military dental clinic, a Mobile Dental Clinic, an Air Transportable Dental System, or onboard a ship. You might be expected to work on a base in Canada or other operations in other parts of the world.

Human resources administrator

Related civilian jobs: Records administrator, data entry supervisor, receptionist, office manager, executive assistant, payroll clerk, and information management technician.

Description: Provide administrative and general human resources support.

Education: Grade 10. No previous work experience or related career skills are required.

Duties: In addition to human resources administration and services, you’ll be handling pay and allowances, managing automated pay systems, and maintaining personnel records.

Work environment: HR administrators work at all CAF bases in Canada. They also work on ships and overseas to support the Canadian Army, Royal Canadian Navy, or Royal Canadian Air Force operations.

Medical assistant

Related civilian jobs: Emergency medical responder, ambulance and first aid attendant, registered nursing assistant, licensed practical nurse, and hospital orderly.

Description: Successful candidates will help treat the sick and injured in CAF units. You’ll be assisting and supporting nursing and medical officers.

Education: Minimum of Grade 11 biology, Grade 10 physics or chemistry, and Grade 10 math.

Duties: You’ll provide initial care and essential life support treatments in trauma cases. You’ll help with health assessments (hearing and vision tests, perform basic lab procedures, etc.) and initiate and manage medical records and reports. You’ll also be expected to provide support and first aid during training exercises.

Work environment: Medical assistants may serve with the Royal Canadian Navy, the Royal Canadian Air Force or the Canadian Army as part of the Canadian Forces Health Services Group. Those in this role are exposed to the same risks as the forces they support.

Business

Porter’s new loyalty program promises to match Air Canada’s Aeroplan status

Porter Airlines is once again stirring the pot among Canadian airline rivals, now going after Air Canada’s Aeroplan members by offering to match their loyalty status to an equivalent of their own.

The beloved airline, which recently ranked as having the best cabin service in North America, challenged the competition for the second time this year, after previously deploying a similar tactic against WestJet in the spring.

Earlier in April, Porter presented customers with a limited-time offer to match the loyalty status of WestJet’s patrons with VIPorter levels.

Now, they’re offering Aeroplan members to seamlessly transition to an equivalent VIPorter Avid Traveller status based on their existing membership tier.

Members can then take advantage of an array of travel perks that come with flying Porter, including seat selection, baggage, and flight changes.

For those currently holding an Aeroplan membership, there are two ways to acquire the Avid Traveller status for the rest of 2023:

Status-Based Match:

- Aeroplan 25K members = VIPorter Venture

- Aeroplan 35K members = VIPorter Ascent

- Aeroplan 50K, 75K, and Super Elite = VIPorter First

Flight Segments-Based Match:

- 5 flight segments = VIPorter Passport

- 8 segments = VIPorter Venture

- 17 segments = VIPorter Ascent

- 28 or more segments = VIPorter First

Members will have to first submit their applications on Porter’s website. Registration will remain open until September 6, 2023.

In order to maintain their membership level through 2024, customers will have until the end of 2023 to reach the following reduced qualifying spend (QS) targets:

- Passport = $500 in QS

- Venture = $750 in QS

- Ascent = $1500 in QS

- First = $2500 in QS

Over the past year, Porter has launched an aggressive expansion strategy, including everything from introducing longer flights on newly-purchased jet planes flying out of Toronto Pearson, free WiFi, and a new all-inclusive economy experience.

With Canadians losing both Swoop and Sunwing as WestJet incorporates both into their mainline business, Porter’s direct competition is welcome to keep prices competitive.